A Rising Inventory

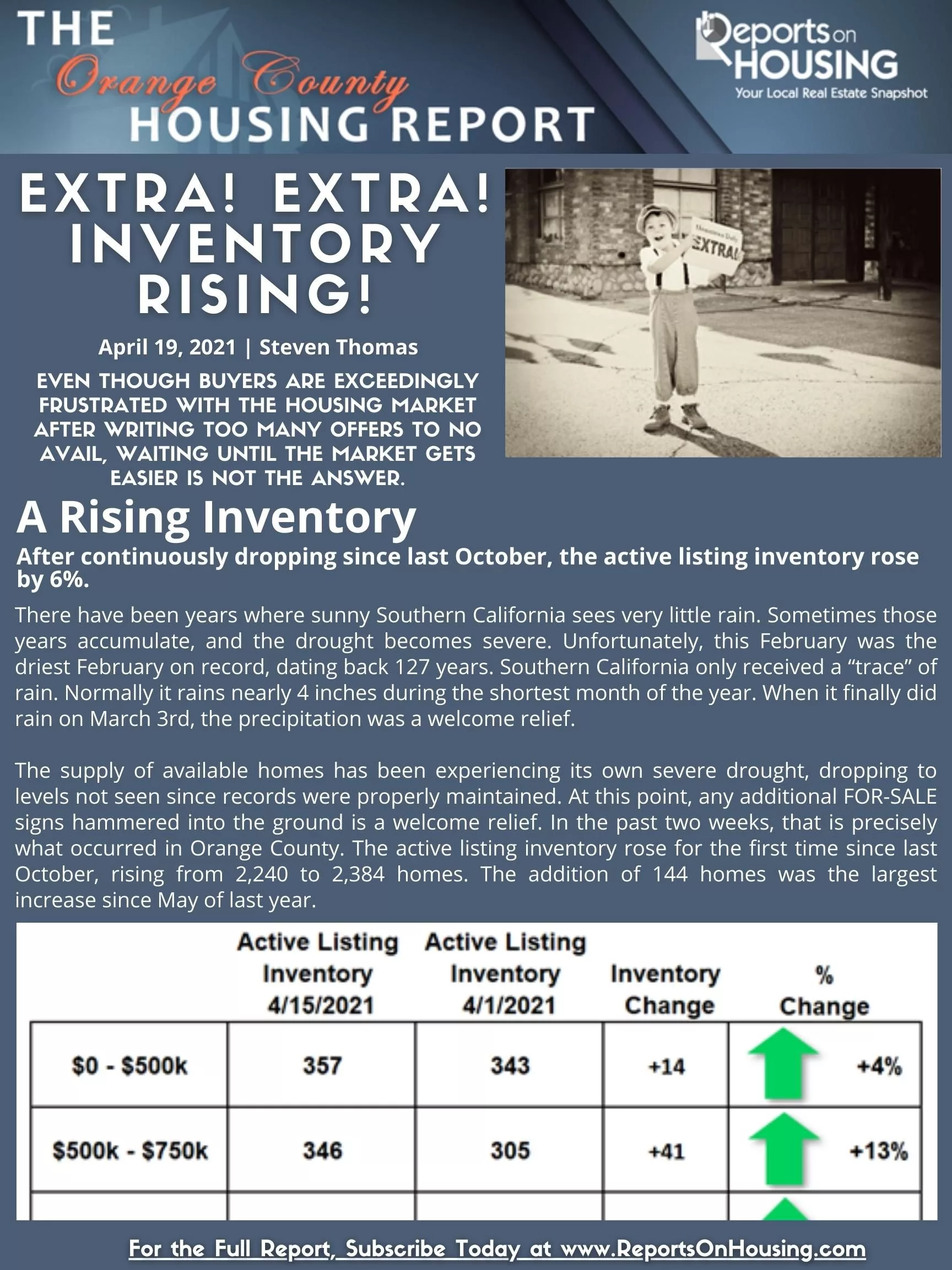

After continuously dropping since last October, the active listing inventory rose by 6%.

Undoubtedly, for the countless buyers struggling to find a home, the extra inventory is a healthy step in the right direction. It is a new trend that should continue until it reaches a peak later in the year. In Orange County, the inventory typically does not peak until July or August. This year, it may peak even later in the year as mortgage rates are anticipated to rise from 3%, where they stand today, to as high as 3.75% by year’s end. Higher rates will decelerate the housing market and many sellers will languish on the market for a much longer period of time when they overprice. This will ultimately delay the peak. It will remain a Hot Seller’s Market, just not as nutty.

In California, for the month of March, nearly two-thirds of all closed sales sold above their list price. Multiple offers and above list sales prices is now the norm. Watching values quickly rise after writing a dozen offers can be disconcerting. As a result, demand, a snapshot of the last 30-days of pending sales, declined by 92 in the past two weeks, down 3%, dropping from 3,162 to 3,070. With fewer pending sales, the housing market can catch its breath as the inventory rises and homes linger on the market just a bit longer than they have been.

A Note to Sellers: It is a great time to get ahead of the curve and accurately price a home right out of the starting gates.

Overpricing a home is not a sound strategy. Sellers want to expose their properties to as many potential buyers as possible. Accurately pricing permits a seller to obtain as many offers as possible. Multiple offer situations allow offers to be pit against each other and, ultimately, it maximizes the price obtained on a home. Later this year, as the market decelerates, overpricing can lead to fewer multiple offers situations and may even result in remaining on the market without success.

A Note to Buyers: Yes, the current market can be very frustrating, but waiting until more homes come on the market down the road is not the answer.

With home values rapidly appreciating and mortgage rates slated to increase as well, buyers who sit on the sideline will ultimately pay more when they reenter down the road. Higher values and higher rates equate to a larger monthly payment. The market is frustrating, but staying the course and continuing to pursue paydirt is the wisest course of action for a buyer in today’s housing market.

Click on the image below the Read the Orange County Housing Report.