Vanishing Lower Ranges

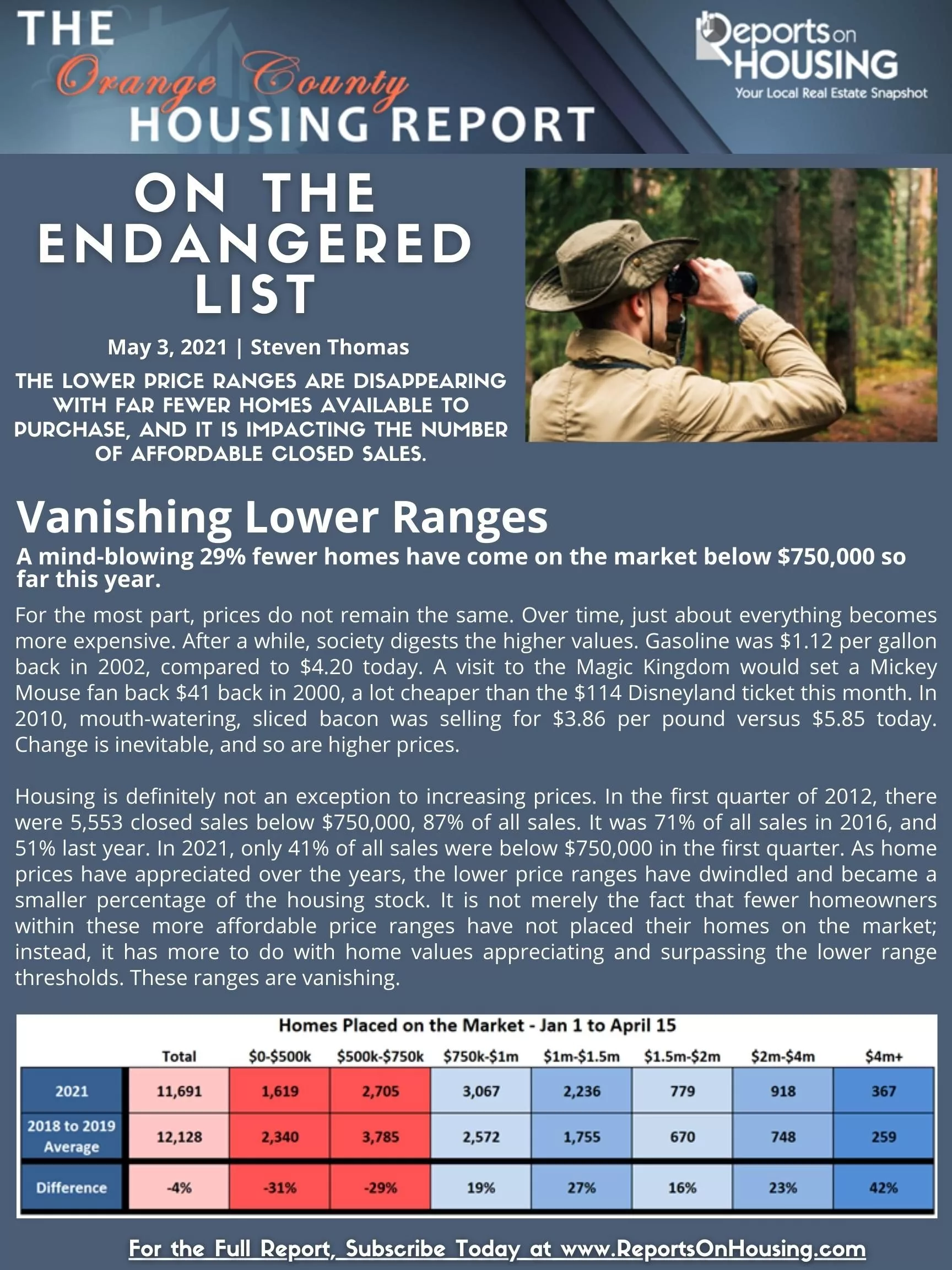

A mind-blowing 29% fewer homes have come on the market below $750,000 so far this year

For the most part, prices do not remain the same. Over time, just about everything becomes more expensive. After a while, society digests the higher values. Gasoline was $1.12 per gallon back in 2002, compared to $4.20 today. A visit to the Magic Kingdom would set a Mickey Mouse fan back $41 back in 2000, a lot cheaper than the $114 Disneyland ticket this month. In 2010, mouth-watering, sliced bacon was selling for $3.86 per pound versus $5.85 today. Change is inevitable, and so are higher prices.

Housing is definitely not an exception to increasing prices. In the first quarter of 2012, there were 5,553 closed sales below $750,000, 87% of all sales. It was 71% of all sales in 2016, and 51% last year. In 2021, only 41% of all sales were below $750,000 in the first quarter. As home prices have appreciated over the years, the lower price ranges have dwindled and became a smaller percentage of the housing stock. It is not merely the fact that fewer homeowners within these more affordable price ranges have not placed their homes on the market; instead, it has more to do with home values appreciating and surpassing the lower range thresholds. These ranges are vanishing.

For buyers anticipating more homes in the affordable price ranges coming on the market soon, it is just not going to happen. The number of opportunities is diminishing over time. Buyers who wait will be confronted with fewer available options to purchase. More and more homes are surpassing the $500,000 and $750,000 thresholds. In 2012, there were 1,941 detached single family residential homes sales below $500,00 in the first quarter, 53% of all detached closed sales, compared to 29 this year, 0.6% of all closings. In 2012, there were 1,001 detached closed sales in the first quarter between $500,000 and $750,000, 27% of all detached closings, versus 721, or 16%, this year. That means that 80% of all detached sales in 2012 were below $750,000. This year, it was just shy of 17%.

The bottom line: while it may be challenging to find a home in the lower ranges today, as homes appreciate, it will only become more challenging in the future.

Click on the image below the Read the Orange County Housing Report.