INTEREST RATES JUICING THE MARKET

Historically low rates have led to the Expected Market Time dropping to 23 days, the lowest level for this time of year since tracking began in 2004.

Values have climbed more than 20% year-over-year and the pace of Orange County housing has not slowed much at all this year. The Expected Market Time (the amount of time between hammering in the FOR-SALE sign and opening escrow) is currently at 23 days, an unbelievably Hot Seller’s Market.

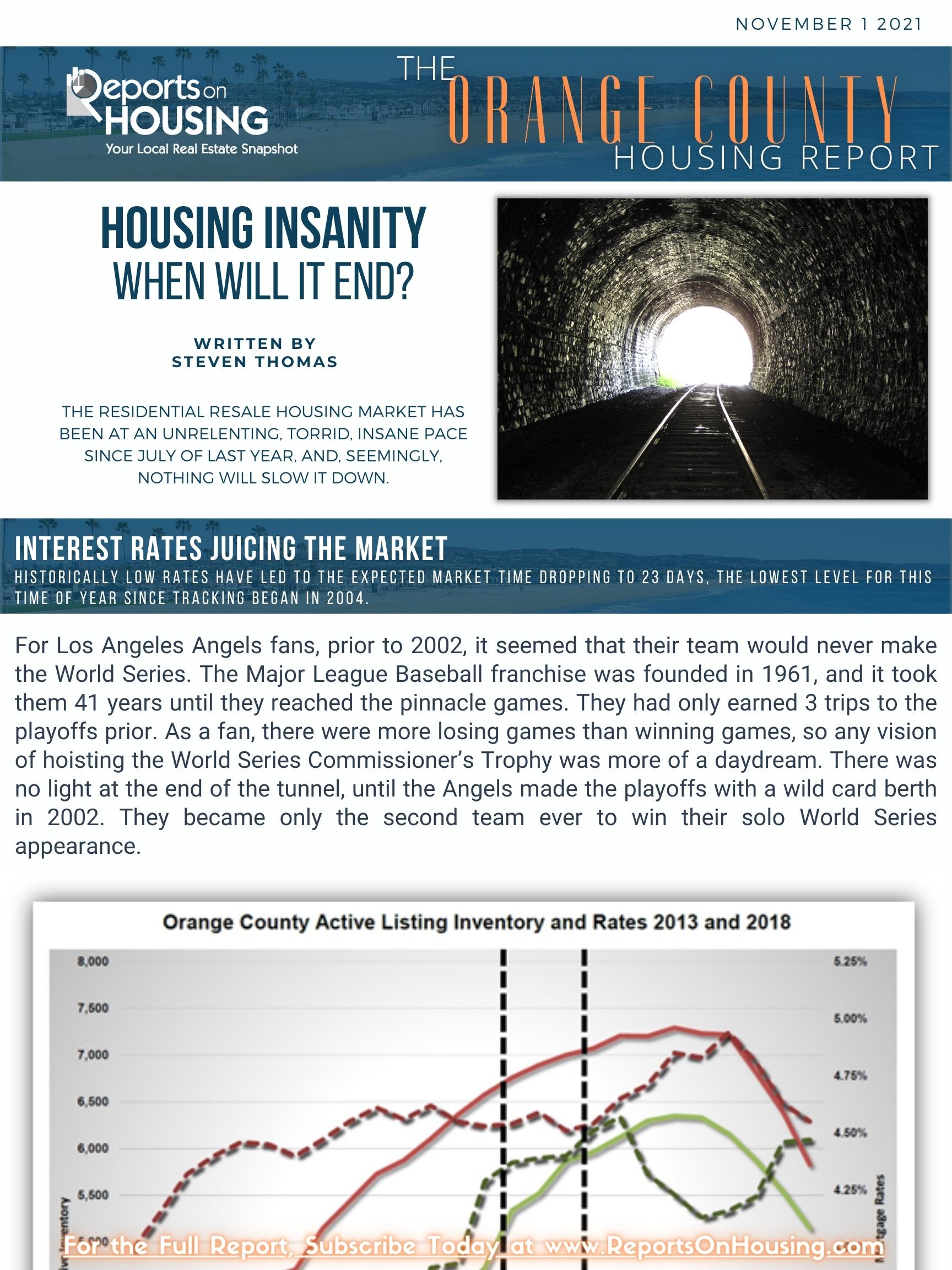

Like today, in 2013 there was a very limited supply of available homes to purchase, a supply crisis with less than 4,000 homes available. Market time was at a very low, insane level, below 40-days to start the year. The inventory remained at a low level until it started to climb in April. It continued to climb until reaching a late peak in October at 6,350 homes, doubling from the low 3,183 level in March. What changed? Mortgage rates. They started 2013 at just over 3.25%, eclipsed 4% in June, and surpassed 4.5% in September.

Similarly, in 2018 there was a supply crisis to start the year with less than 4,000 homes available. Yet, this time interest rates rose rapidly from 4% at the start of January to nearly 4.5% by March. It did not stop there either, making its way to almost 5% by November. With rapidly rising rates, demand was muted during the Spring Market, off by 12% compared to the prior 3- year average. Demand dropped by 28% from its peak in May to October, the inventory doubled from the start of the year to its peak in October, and the market time increased from 51 days in February to 110 days in October, a Balanced Market.

This year there really has been no relief in the relentless pace of real estate due to the historically low mortgage rate environment. According to Freddie Mac’s Primary Mortgage Market Survey®, mortgage rates have risen to 3.14% the highest level since March. For proper perspective, after the start of the pandemic, rates reached 17 record lows, the 17th was during the first week of January of this year at 2.65%. Yes, rates have risen from there, but keep in mind that prior to the pandemic, today’s 3.14% rate would be an all-time low. They remain at very low levels, which is why the active listing inventory is 67% below the 3-year average between 2017 and 2019, prior to the pandemic, demand is 11% higher, and the market time is stuck well below 40-days.

The light at the end of the tunnel with a shift in the market will not occur until mortgage rates rise substantially. Freddie Mac forecasted a couple of weeks ago that mortgage rates will rise to 3.5% in a year from now. That is not quite enough to slow housing meaningfully. Either rates eventually climb to slow housing, or values will climb to the point that they soften demand. The Orange County housing market is just not there yet.

Click on the image below the Read the Orange County Housing Report.