Interest Rates

The current 30-year mortgage rate is at 2.7%, a 14th record low since March

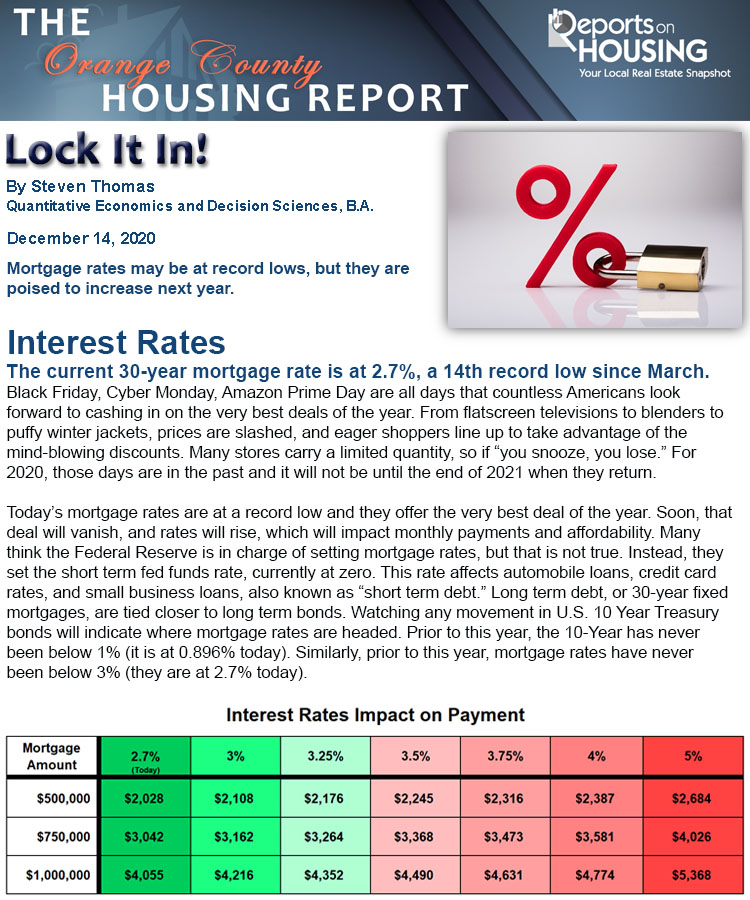

Today’s mortgage rates are at a record low and they offer the very best deal of the year. Soon, that deal will vanish, and rates will rise, which will impact monthly payments and affordability. Many think the Federal Reserve is in charge of setting mortgage rates, but that is not true. Instead, they set the short term fed funds rate, currently at zero. This rate affects automobile loans, credit card rates, and small business loans, also known as “short term debt.” Long term debt, or 30-year fixed mortgages, are tied closer to long term bonds. Watching any movement in U.S. 10 Year Treasury bonds will indicate where mortgage rates are headed. Prior to this year, the 10-Year has never been below 1% (it is at 0.896% today). Similarly, prior to this year, mortgage rates have never been below 3% (they are at 2.7% today).

For a $750,000 mortgage, today’s 2.7% payment of $3,042 per month would rise to $3,368 at 3.5%. That is a difference of $326 per month, or $3,912 per year. 3.5% is still a great rate, yet there is still a significant impact in the monthly mortgage payment. In November 2018, about two years ago, mortgage rates climbed to 5%. In comparison to today, for a $750,000 mortgage, the payment would be an additional $1,004 per month, or $12,048 per year. Today’s record low rates provide buyers and homeowners the ability to save a lot of money.

Click on the image below the Read the Orange County Housing Report.