Orange County Housing Report: A 2021 Forecast

Active Inventory

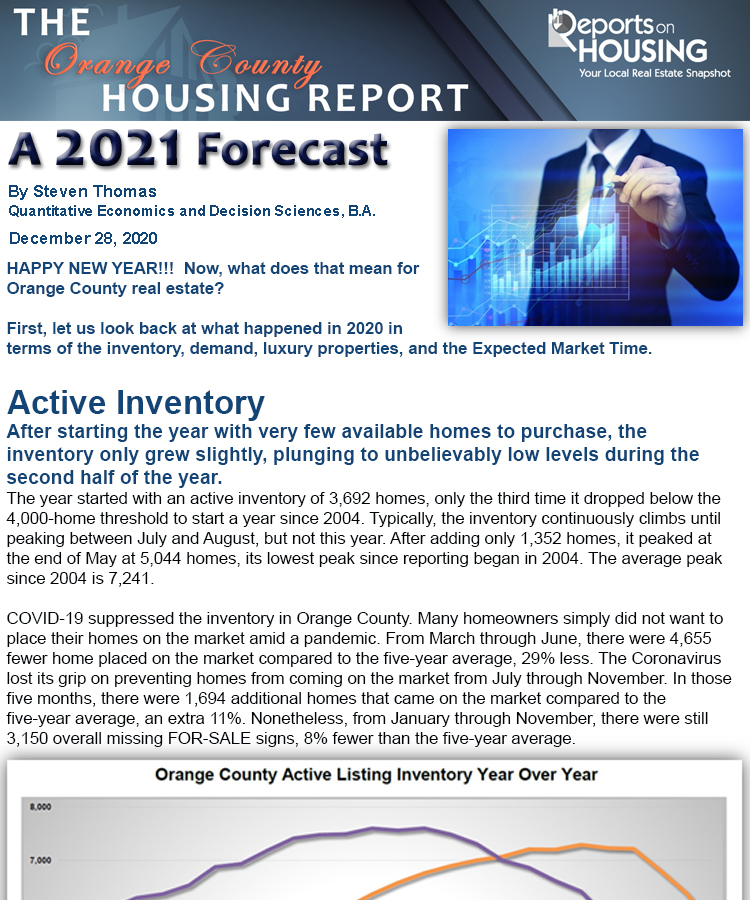

After starting the year with very few available homes to purchase, the inventory only grew slightly, plunging to unbelievably low levels during the second half of the year.

COVID-19 suppressed the inventory in Orange County. Many homeowners simply did not want to place their homes on the market amid a pandemic. From March through June, there were 4,655 fewer home placed on the market compared to the five-year average, 29% less. The Coronavirus lost its grip on preventing homes from coming on the market from July through November. In those five months, there were 1,694 additional homes that came on the market compared to the five-year average, an extra 11%. Nonetheless, from January through November, there were still 3,150 overall missing FOR-SALE signs, 8% fewer than the five-year average.

Demand

Initially, COVID-19 impacted demand substantially, but record low mortgage rates saved the day and demand soared.

The impact on demand was catastrophic, dropping to 1,080 by mid-April. That was a 60% drop, or 1,630 fewer pending sales, compared to mid-April 2019. It was the lowest level since January 2008. Initially during the lockdown there were no showings or open houses allowed. That changed at the end of March when real estate was reclassified as an “essential service”. Yet, even with low a low mortgage rate environment, there was not a lot of appetite for buyers to purchase in April. That all changed by the start of May, just as mortgage rates dipped to another record low level at 3.23%. Buyers reemerged and demand climbed from 1,172 to 2,035 pending sales in only four weeks, a 74% rise. By the end of June demand was at its strongest level in five years. Typically, demand peaks in the middle of the Spring Market between April and May, but after dropping to lows in April that were last recorded during the Great Recession, the market continued to improve. Instead, demand peaked at the beginning of September at 3,340 pending sales, its highest peak since 2012.

The 2021 Forecast

A hot year for housing

The year 2020 was going to be one of the hottest years on record for the U.S. economy. That all came to an abrupt halt in March due to the Coronavirus Pandemic. With a national emergency and stay-at-home orders across the country, the U.S. was thrown into a recession. Yet, this was not like any other recession. Recessions are typically caused by one sector of the economy dramatically turning negative, which pulls down the entire country to negative territory. This time it was a forced shutdown of the economy to save lives from a once-in-a-lifetime pandemic. Every economic chart was impacted, from consumption to unemployment to equities, nothing was spared. The Federal Reserve did everything in their power to mitigate the damage to the economy, and Washington D.C. provided major relief packages to aid the unemployed and small business owners. The GDP had its worst quarter over quarter reading in the history of the U.S. during the second quarter, followed by the best quarter over quarter reading during the third quarter. The economy has dramatically improved, but there is still a long way to go. It will take a bit more time due to the slow rollout of the recently approved vaccines. The low interest rate environment will continue and will be a tailwind that will not only aid the recovery to the economy, but it will also continue to fuel the incredible run on housing in 2021. As a result, the local housing market is going to be HOT in 2021.

Click on the image below the Read the Orange County Housing Report.