The Coming Change

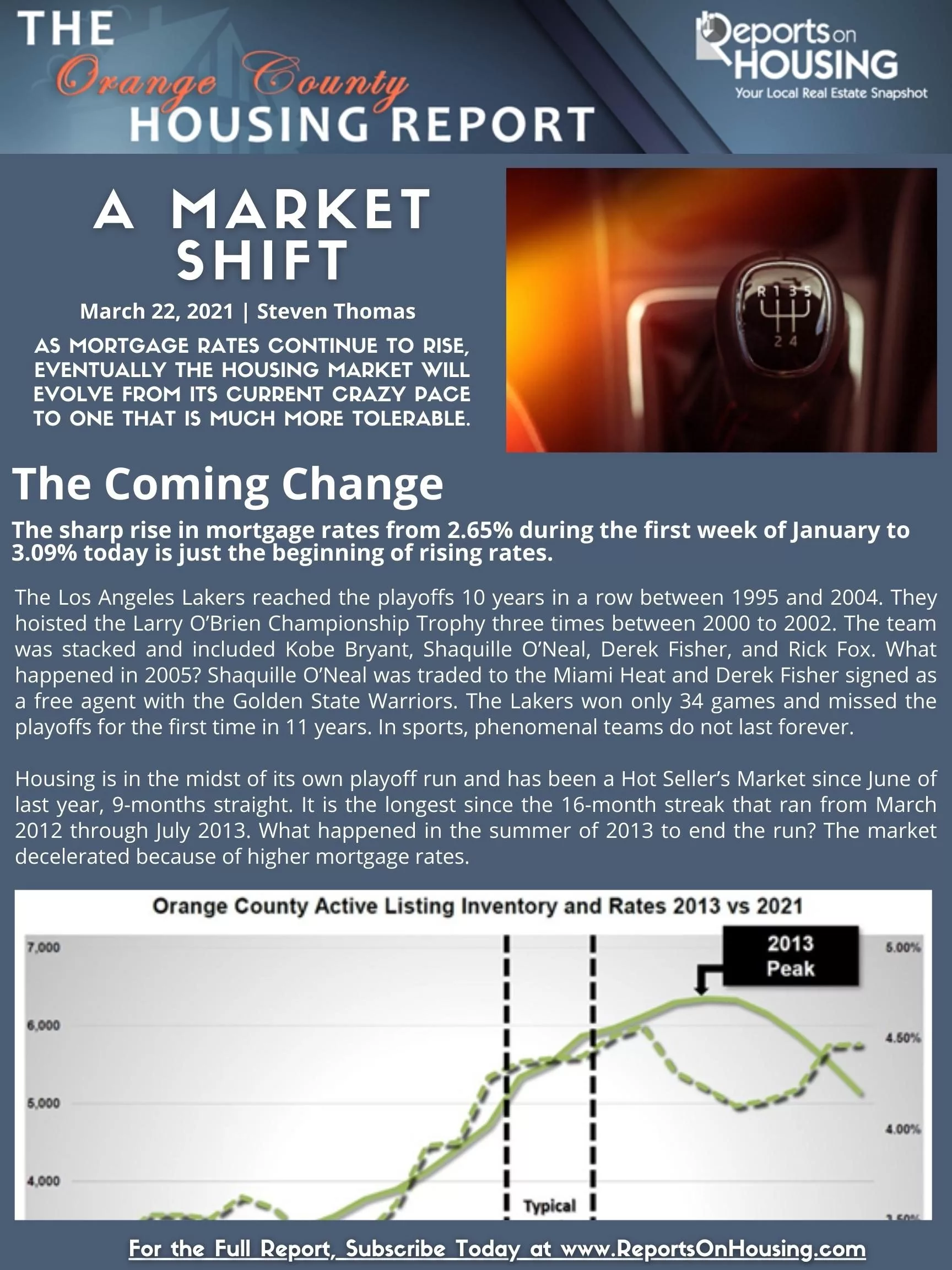

The sharp rise in mortgage rates from 2.65% during the first week of January to 3.09% today is just the beginning of rising rates.

In 2013, there was very little supply and low mortgage rates were juicing demand. Doesn’t that sound familiar? A low supply and a truck load of demand? The difference between 2013 and 2021 is that the supply of available homes to purchase today is even lower and demand is a bit higher due to even lower mortgage rates.

Now experts are expecting a robust second half of 2021, just a few months away, the start of the next “Roaring 20’s.” Mortgage rates are projected now to increase anywhere between 3.5% to 4%, depending on the size of the economic boom. That is precisely where they were bouncing around prior to the pandemic, a much more normal range. These higher rates will be the catalyst to the market shift and the market will decelerate.

AN IMPORTANT NOTE: It will still be a Hot Seller’s Market.

This is NOT a shift to a Buyer’s Market. This a shift from a housing market that is currently nuts, appreciating at about 1% per month, to a regular Hot Seller’s Market with normal, 4% to 5% appreciation per year. Sellers who overprice will sit and languish on the market.

Click on the image below the Read the Orange County Housing Report.