Cost of Waiting

Housing will become more unaffordable as homes continue to rapidly appreciate and mortgage rates rise.

It feels like a dog chasing its own tail, a pointless exercise that ends in exhaustion. After writing offer after offer with no success, many buyers become discouraged and question whether they should continue to pursue their dream in purchasing a home. Maybe they should wait until the market is not so blistering hot, or until they have a larger down payment, or when there are more homes available. The facts and data illustrate why waiting is not a great strategy at all.

With a record low supply of available homes to purchase paired with unstoppable demand powered by historically low mortgage rates, home values are anticipated to continue to increase at a pace of about 1% per month through the end of the year. That equates to a home appreciation of 8% from now through December. At the same time, the United States economy is revving its massive engine now that it is emerging from the depths of the pandemic. Excellent job reports, increased travel, a massive personal savings surplus, and a return to some semblance of normal life again will ignite the economy and translate to a rise in mortgage interest rates. It is already occurring. According to Freddie Mac’s Primary Mortgage Market Survey®, rates started the year at 2.65%, an all-time record low, and have since risen to 3.125%. That is nearly a half a point higher in just a few months. By year’s end, rates are forecasted to hit 3.75% or higher.

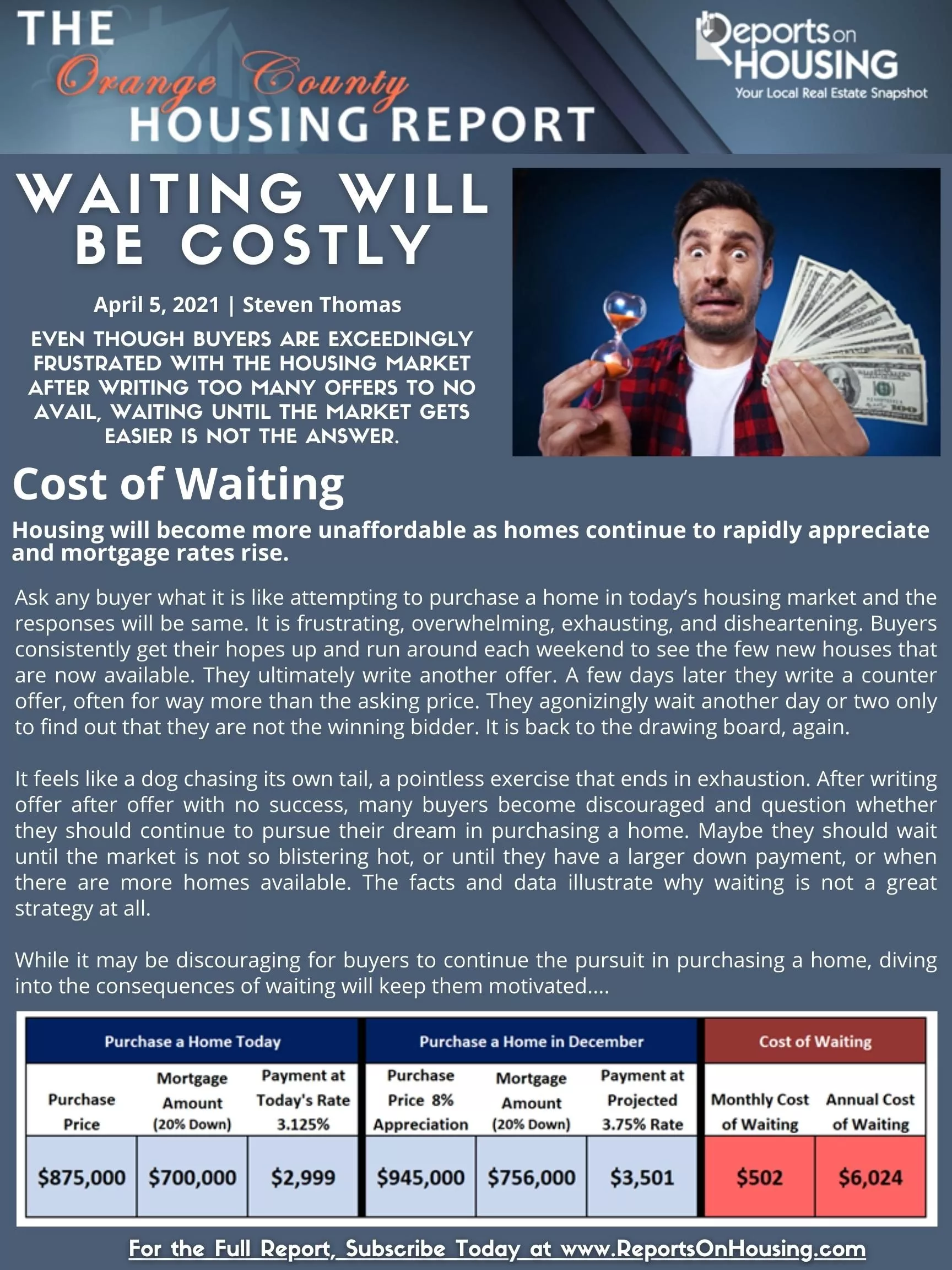

That means that the $875,000 home example above will appreciate to $945,000 in December. Match that up with the expected 3.75% mortgage rate, and the monthly payment blossoms from $2,999 to $3,501 per month, an increase of $502 every single month for the life of the loan. That is $6,024 per year or $30,120 in five years. This example only factors the increase in the principal and interest payment. The 20% down payment for $945,000 is an extra $14,000 down. Property taxes go up too. With the average tax rate of 1.1%, that amounts to an additional $770 annually.

The current number of available homes to purchase is at a record low 2,240. The five-year average (from 2015 to 2019 and intentionally excluding 2020 as the numbers were skewed due to the pandemic) is 5,552, or 148% more. That is an extra 3,312 homes on the market. Current demand (a snapshot of the last 30-days of pending activity) is at 3,162 compared to the five-year average (2015 to 2019) of 2,796, or 18% more. That is today’s trend in housing, an ultra-low supply of available homes matched up with fiery, hot, insane demand. With rising rates, the inventory will finally rise from its unparalleled, anemic low level, and demand will decline from its torrid pace. The result will be a market that is much more manageable to navigate, yet still a Hot Seller’s Market. Homes will still appreciate, just not at its current unparalleled pace. There will still be multiple offers, just a few generated on each property compared to the double digits of today.

For buyers, the answer is simple, do not wait to purchase. Waiting will be costly

Click on the image below the Read the Orange County Housing Report.