Low Rates Prop Up Affordability

Even with record level home prices, low mortgage rates have kept affordability in check.

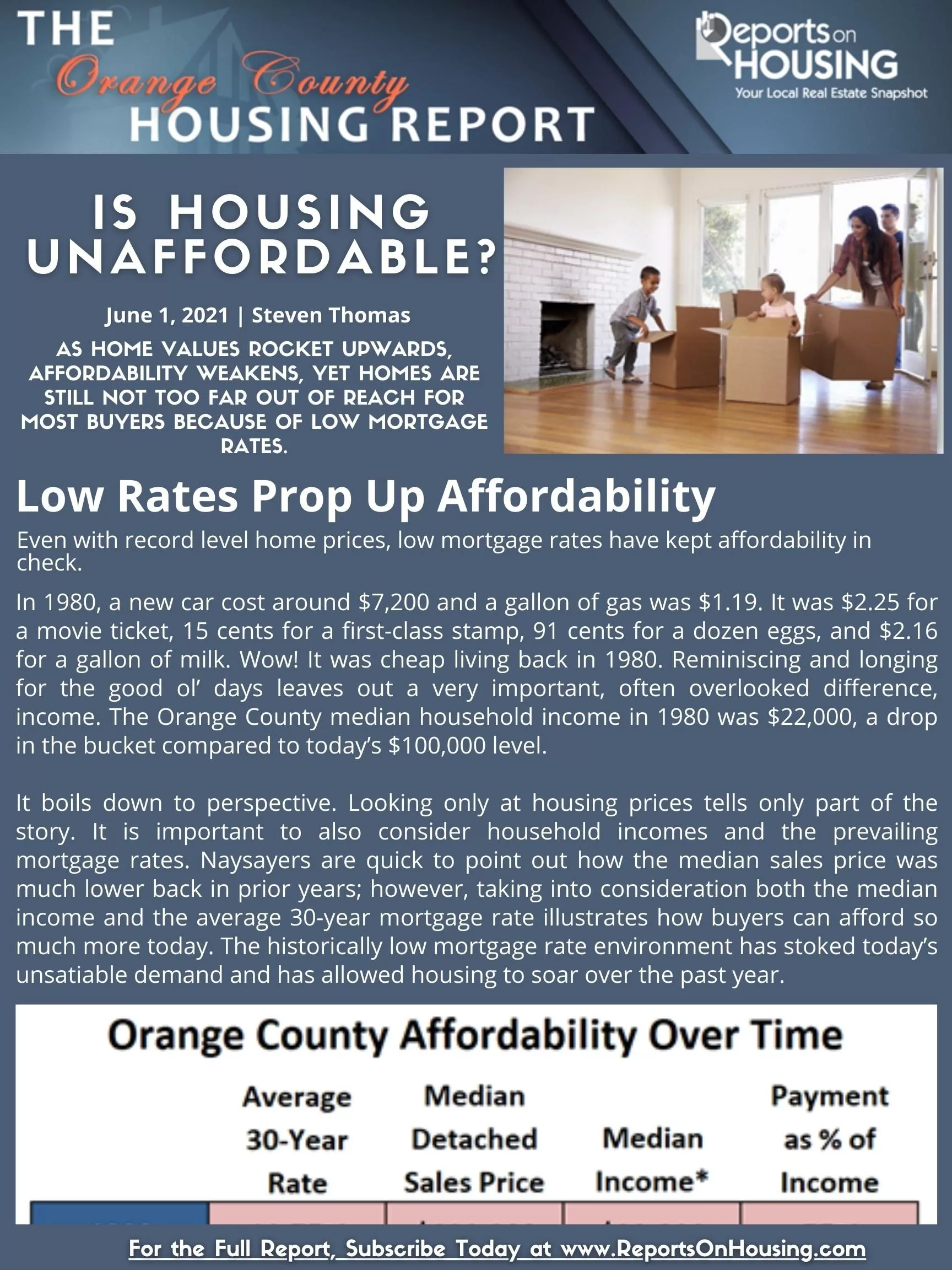

To understand where this heightened demand and buyer’s exuberance is coming from it is necessary to consider where interest rates and income have historically been and their impact on affordability. The chart below highlights how higher interest rates limit the price of a home that a buyer can afford. In 1980, the average mortgage rate was 13.75%, the median income was $22,000, and the median detached sales price was $108,000. That meant that the monthly housing payment was 55% of a homeowner’s income. Rates continued to drop and incomes climbed decade after decade. In 2000, mortgage rates were at 8%, the median income grew to $56,000, and the median detached sales price had blossomed to $317,000. Yet, the monthly payment was only 40% of a homeowner’s income. It swelled to 59% in 2007, just prior to the start of the Great Recession, and dropped to 33% in 2012 as housing began to climb once again. Flash forward to today’s 3% mortgage rate, $101,000 median income, and a record setting April median detached sales price of $1,100,000, and the monthly housing payment is 44% of a homeowner’s monthly paycheck.

Mortgage rates reached 17 record lows since the start of the COVID-19 pandemic, which dropped the monthly payment substantially. That meant that a much smaller slice of a homeowner’s monthly paycheck went t0 paying the mortgage payment. It dropped to 37% last year, prompting buyer demand to escalate. As a result, prices surged and incomes have not kept up; thus, affordability eroded and now stands at 44%. But it has climbed to much higher levels in the past. In perspective, today’s level is not yet concerning.

It is important to note that when interest rates do rise down the road, that it will impact affordability considerably. At today’s $1,100,000 median detached sales price and $101,000 household income, a 3.5% rate would result in a monthly payment that would be 47% of a homeowner’s income. At 3.75% it would rise to 49%. Today’s historically low mortgage rates have led to a heightened sensitivity to smaller rises in mortgage rates. As rates rise in the future, the housing market will most certainly downshift.

The bottom line: In conidering today’s ultra-low mortgage rate and rising median household income, the monthly payment for the record level median detached sales price is still affordable.

Click on the image below the Read the Orange County Housing Report.