The Distressed Market

Fewer homeowners are opting to sell despite homes appreciating to record levels.

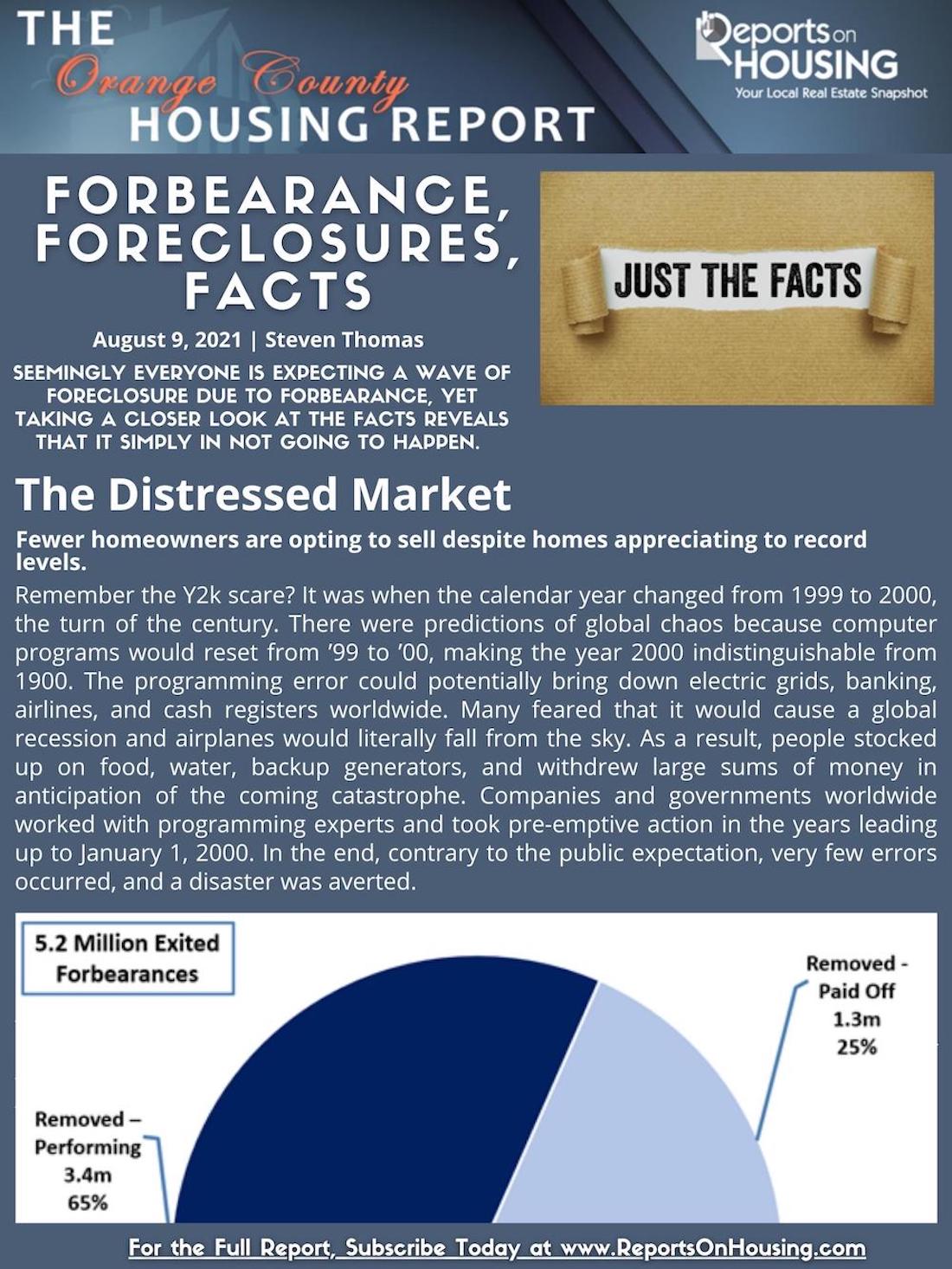

Everyone seems to jump to the plight and struggles of the Great Recession and believe that the housing market is about to repeat itself. Yet, in August 2008, 9.2% of all U.S. mortgages were either delinquent or in foreclosure. By September 2009, it had risen to 14.4%. Today, 3.4% of all mortgages are in forbearance, which amounts to 1.7 million homeowners. The vast majority of those that remain in forbearance will perform and not become a foreclosure or short sale statistic. Why not? It is important to dive a bit deeper and take a look at the huge number who have already exited forbearance.

At the start of the Great Recession, the supply of available homes to purchase was way too high, over 6 times where it stands today with only 2,520 homes currently available in Orange County. Placing homes on the market, even foreclosures, when housing is starved for more inventory like it is today, will be easily snapped up in an instant. Buyers would welcome the relief of any additional inventory right now and into the foreseeable future. The plight of not enough homes will linger for the rest of the year and throughout 2022 as well.

The bottom line: there will be no wave of foreclosures due to forbearance.

The sky is not falling. Instead, everyone should expect more of the same. The ultra-low, anemic inventory will remain, and demand will be juiced due to historically low mortgage rates.

Click on the image below the Read the Orange County Housing Report.