Your search results

Housing Report 2021-12-13-Not About The Price

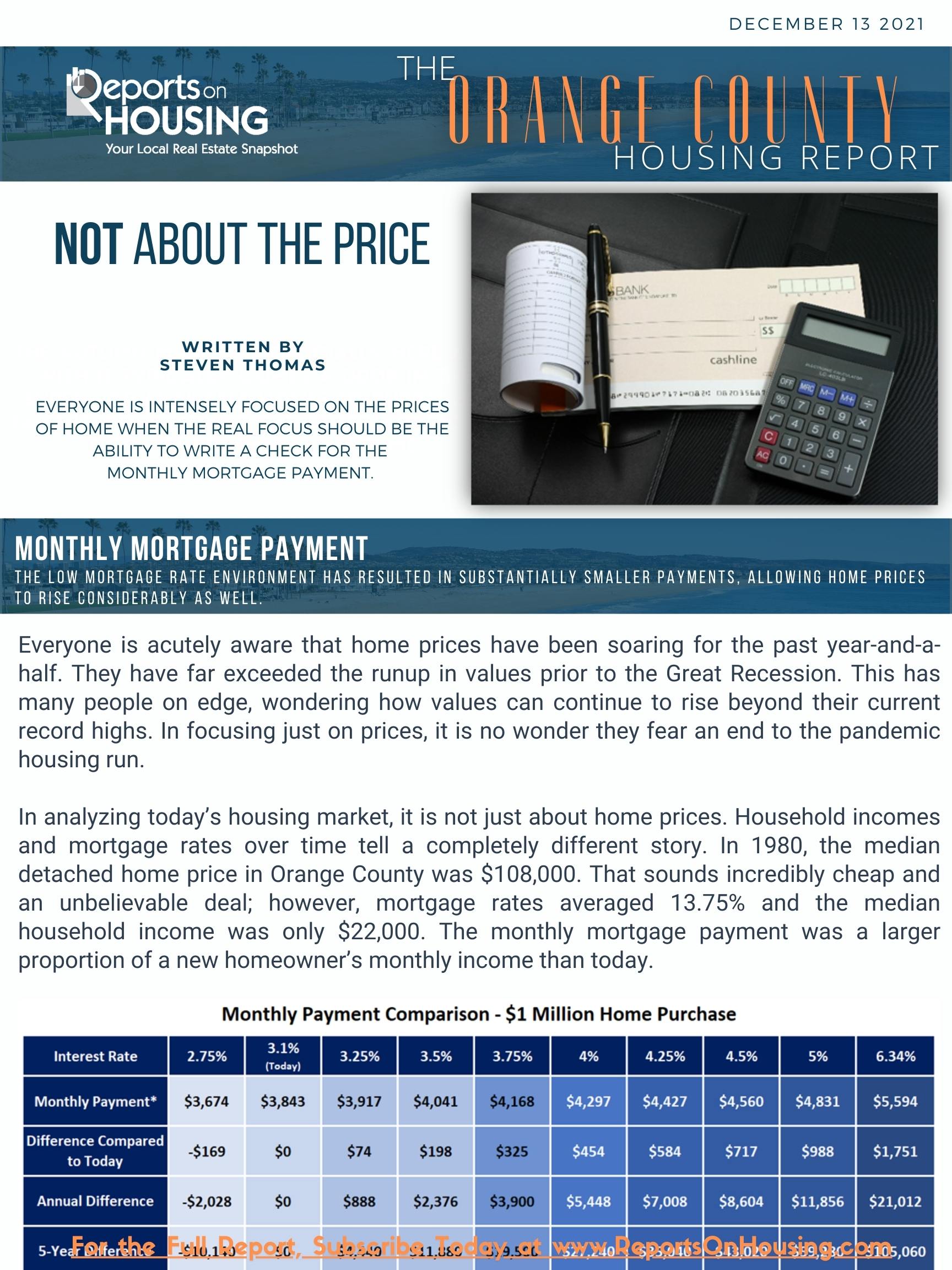

MONTHLY MORTGAGE PAYMENT

The low mortgage rate environment has resulted in substantially smaller payments, allowing home prices to rise considerably as well.

Everyone is acutely aware that home prices have been soaring for the past year-and-a- half. They have far exceeded the runup in values prior to the Great Recession. This has many people on edge, wondering how values can continue to rise beyond their current record highs. In focusing just on prices, it is no wonder they fear an end to the pandemic housing run.

In analyzing the housing market and where it stands today, home prices are a critical component, yet household incomes and mortgage rates are equally important factors as well. As household incomes rise, families’ monthly paychecks rise. As interest rates drop, home buyers are looking at smaller monthly payments.

These comparisons put today’s housing run into proper perspective. Rates are not projected to climb to 4% or higher any time soon, yet it is where rates have been in the past. The higher rates were accompanied by lower household incomes as well. Current trend lines indicate that low mortgage rates are here to stay, and household incomes will continue to methodically climb.

Buyers should ultimately approach the home purchasing process by taking a careful look at their family budgets.

What a buyer pays should be in alignment with their budget and monthly payment comfort level. After purchasing, buyers will be sitting down and writing a check out to the mortgage company each and every month. After closing escrow, they will no longer care too much about how much they paid for their home. Instead, they will care about the monthly mortgage payment that is deducted from their checking account for the next 30 years.