EVEN THOUGH HOUSING IS INSANELY HOT, TRENDS HAVE EMERGED THAT CONFIRM THAT THE ORANGE COUNTY HOUSING MARKET IS STARTING TO COOL

CRACK – The current active inventory has increased by 60% since mid-January.

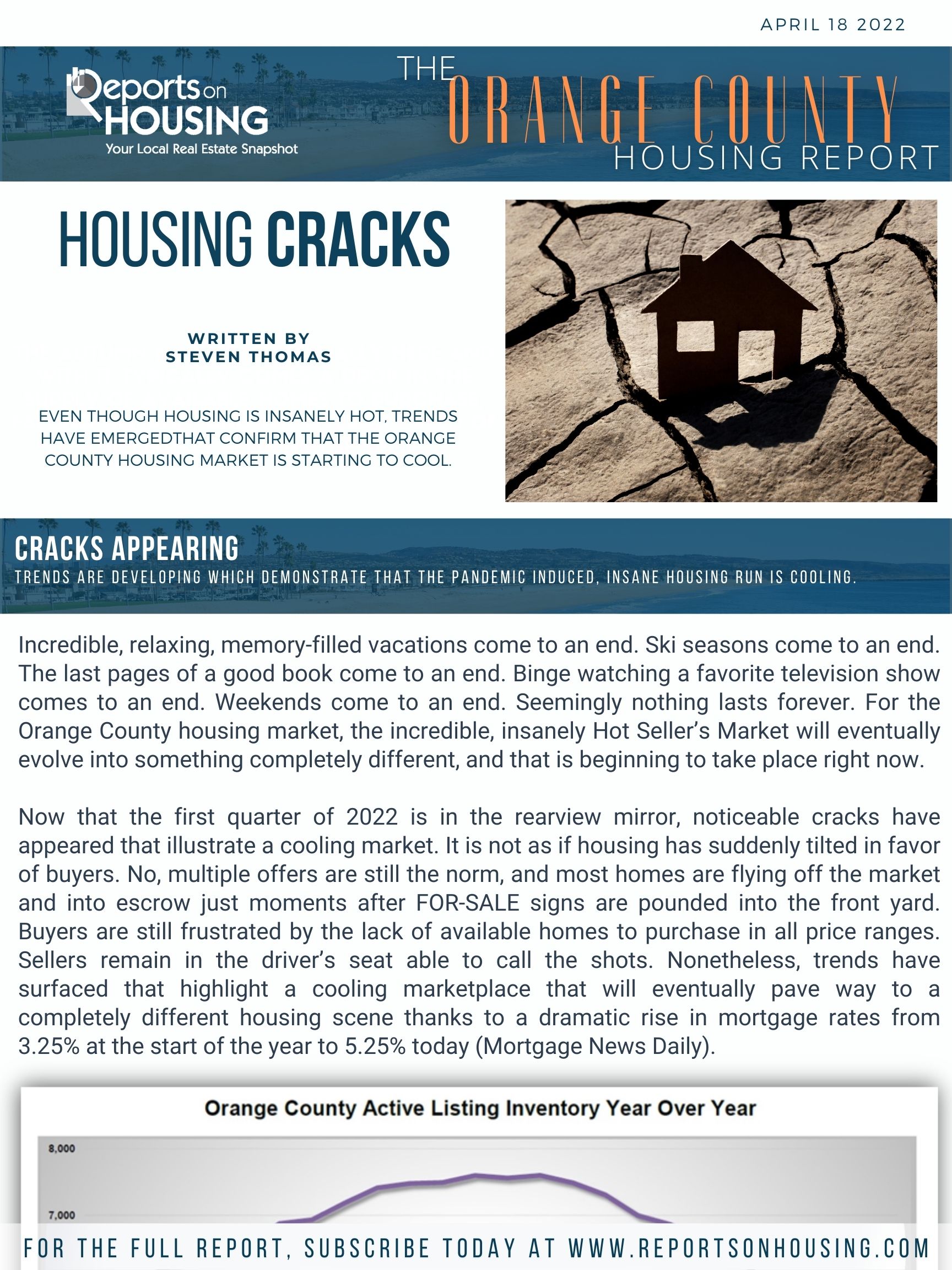

From January 20th through today, the number of available homes to purchase has risen from 1,080 to 1,732, up an astonishing 60%, or 652 additional homes. The inventory has struggled to grow since 2020, the start of the pandemic. It is the largest gain since 2019. Today’s level is still extremely anemic and far below normal levels, yet is a trend that demonstrates that not all homes are selling instantly. It will not be long before there are more homes on the market this year compared to 2021. Last year everything that was placed on the market was slammed into escrow. That is not the case today even with a muted number of homes coming on the market.

CRACK – Other than COVID-19 lockdowns of 2020, demand is at its lowest level for this time of the year since 2007 and is already trending lower.

Demand, a snapshot of the number of new escrows over the prior month, has been muted since the start of the year and has stalled within the past several weeks. Today’s demand is at 2,241 pending sales, down 27% compared to last year. The 3-year average demand reading prior to COVID (2017 to 2019) for this time of year was at 2,777 pending sales, 24% more than today. Demand readings have been muted by a lack of available homes and fewer homes coming on the market; yet, demand is still falling while the inventory is climbing. Typically, during the Spring Market, pending sales activity is firing on all cylinders, the busiest time of the year, and continues to climb until peaking between the end of April to the middle of May. Demand most likely already peaked at the end of March. It has not been this low in mid-April (ignoring the lockdowns of April 2020 that only initially impacted demand) since 2007 when it measured only 1,910 pending sales.

CRACK – A staggering 15% of all available homes to purchase today reduced their asking price.

The Multiple Listing Service (MLS) has a helpful red arrow pointing downward adjacent to the asking price if the asking price was reduced. There are a lot more red arrows pointing down, which last occurred in 2019 when there were over 6,000 homes available. This phenomenon is indicative of a market where buyers are quickly becoming less interested in overpriced homes. Many sellers are arbitrarily pricing and stretching the asking price in anticipation of selling for much higher than the most recent pending or comparable sell. While this strategy may have worked over the past couple of years, buyers will become less willing to stretch in price as the year progresses. Many sellers will have to reduce their asking price to find success, and, in many cases, more than once.

CRACK – Like Orange County, all counties in Southern California are experiencing stalled demand along with enormous drops in year-over-year readings.

It appears as if demand has stalled for all markets, peaking between mid-March to the end of March. Demand typically peaks between the end of April to the end of May, but soaring mortgage rates has pulled that peak forward and demand has stalled. All Southern California markets are experiencing recent drops in demand at a time when it is normally rising. The 3-year average rise in SoCal demand (2017 to 2019) from mid-March to mid-April was 8% compared to Southern California’s 1.6% drop. Year-over-year drops are staggering as well, off by 17% throughout the region. The bottom line: the trend of a cooling market is not just isolated to Orange County. It is affecting all Southern California.