FOR HOMEOWNERS LOOKING TO SELL IN 2022, THE WINDOW OF OPPORTUNITY IS CLOSING AS THE INVENTORY CLIMBS, DEMAND FALLS, AND MARKET TIMES GROW LONGER.

Every time the housing market transitions away from a Hot Seller’s Market, too many homeowners fall victim to waiting to sell. They do not understand the magnitude of the current market shift and how quickly the market has evolved so far in 2022, and where it is going from here. Many will be kicking themselves as they learn the hard way what it is like to sell in a much slower market during the second half of this year. It will be a case of “you snooze you lose,” as many sellers will have an extremely hard time finding success.

The best time of the year to sell a home is during the Spring Market, from mid-March to the end of May. That is when the most escrow activity takes place, demand peaks, and the inventory climbs. From their housing transitions to the Summer Market, the second-best time of the year to sell, from the end of May when the kids get out of school through mid-August when they all return to the classroom. With all the distractions of summer, from family vacations to hitting the beach, demand diminishes, and the inventory continues to climb.

While homes were flying off the market at an unprecedented pace and buyers paid aggressively over the asking prices, mortgage rates rapidly climbed in the background. They were at 3.25% at the start of the year, grew to 4.25% in March when the Orange County market was at its hottest point, and continued to grow until it hit 6.28% in June after a hotter than expected read on inflation, the Consumer Price Index (CPI). It has receded to 5.77% today, according to Mortgage News Daily, still at heights last seen in 2008. The higher interest rate environment has taken an enormous bite out of home-affordability, which is why demand (a snapshot of new escrow activity over the prior month) is at its lowest level for this time of year since tracking began in 2004 and is down 61% compared to last year. As a result of diminished demand, the inventory has climbed from 1,100 home at the start of the year to 3,803 today, up 50% compared to last year. Keep in mind that the overall inventory is still down substantially compared to where it was prior to COVID. The 3-year average inventory from 2017 to 2019 was 6,708 homes, 76% higher than today’s level. Muted demand is currently matched with a muted supply.

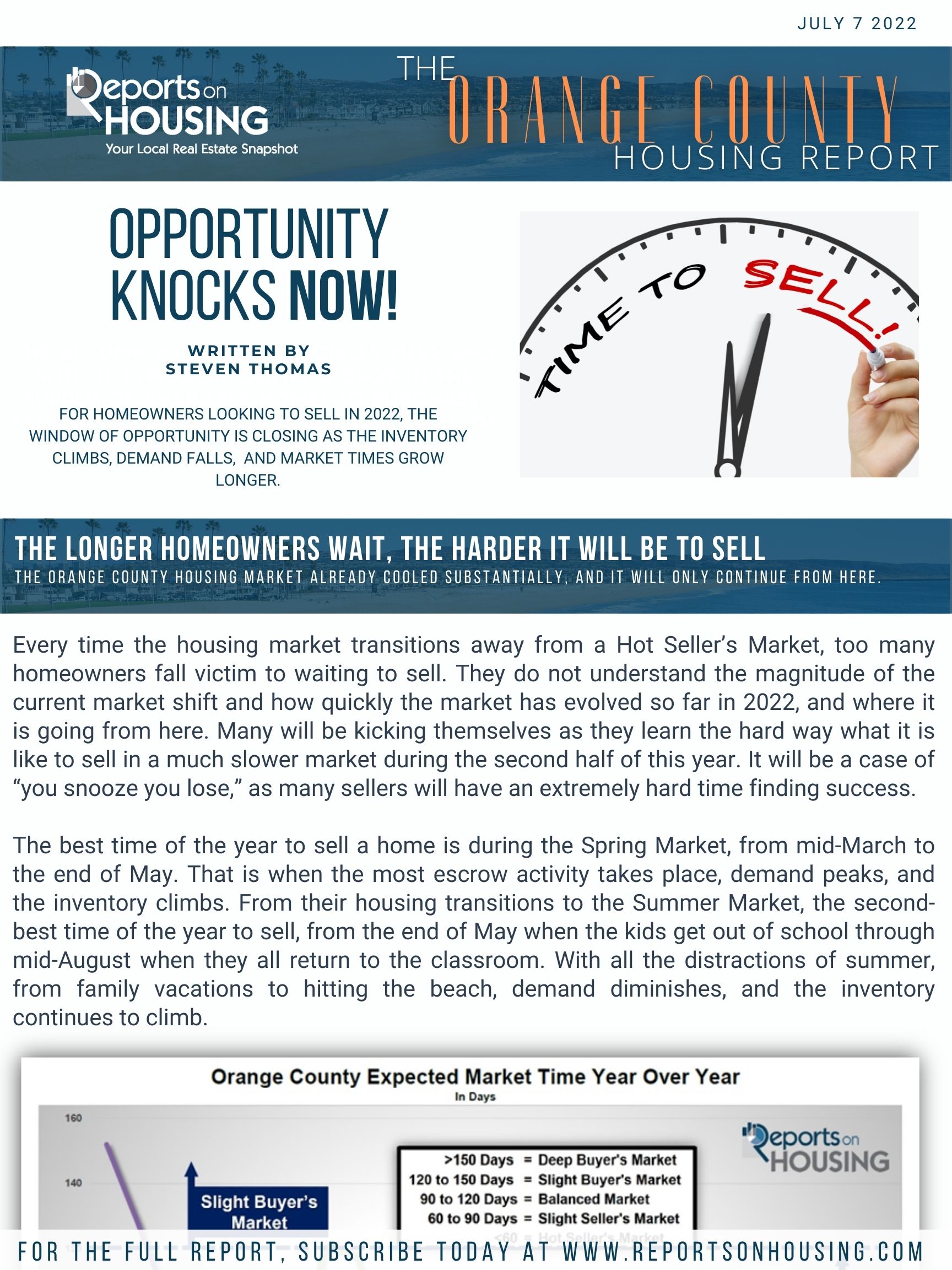

This is what homeowners need to understand: the inventory will unrelentingly rise from now until it peaks during the Autumn Market, demand will methodically drop for the remainder of the year, and the market time will grow longer and longer. At today’s 67-day level, it is a Slight Seller’s Market (between 60 and 90 days) where sellers get to call more of the shots, but there are fewer multiple offers and home values are not appreciating as fast as they have been over the past couple of years. The market is no longer instant and properly pricing is absolutely crucial to find success.

The Expected Market Time will grow from 67-days to over 90-days within the next couple of months, and the Orange County housing market will transition to a Balanced Market (between 90 to 120 days), one that does not favor sellers or buyers and home values are no longer climbing. Depending upon where mortgage rates are during the autumn, housing could even reach a Slight Buyer’s Market (between 120 and 150 days), where buyers get to call the shots, yet home values are still not changing much. If a Slight Buyer’s Market persists with duration, for more than four months, prices could start to slowly decline. Any declines would be small as there is a real stickiness to home values due to the strength of the housing stock. There will be very little seller desperation.

The bottom line for homeowners thinking about selling: The longer they wait, the slower and more challenging the market will be.

Right now, the market is still strong. Sellers will achieve success IF they price their homes according to their Fair Market Value. Opportunity is knocking.

Click on the image below the Read the Orange County Housing Report.