HIGHER 30-YEAR MORTGAGE RATES ARE HAVING A MAJOR IMPACT ON ORANGE COUNTY DEMAND, NOW AT LEVELS FAR BELOW TYPICAL SPRING AVERAGES.

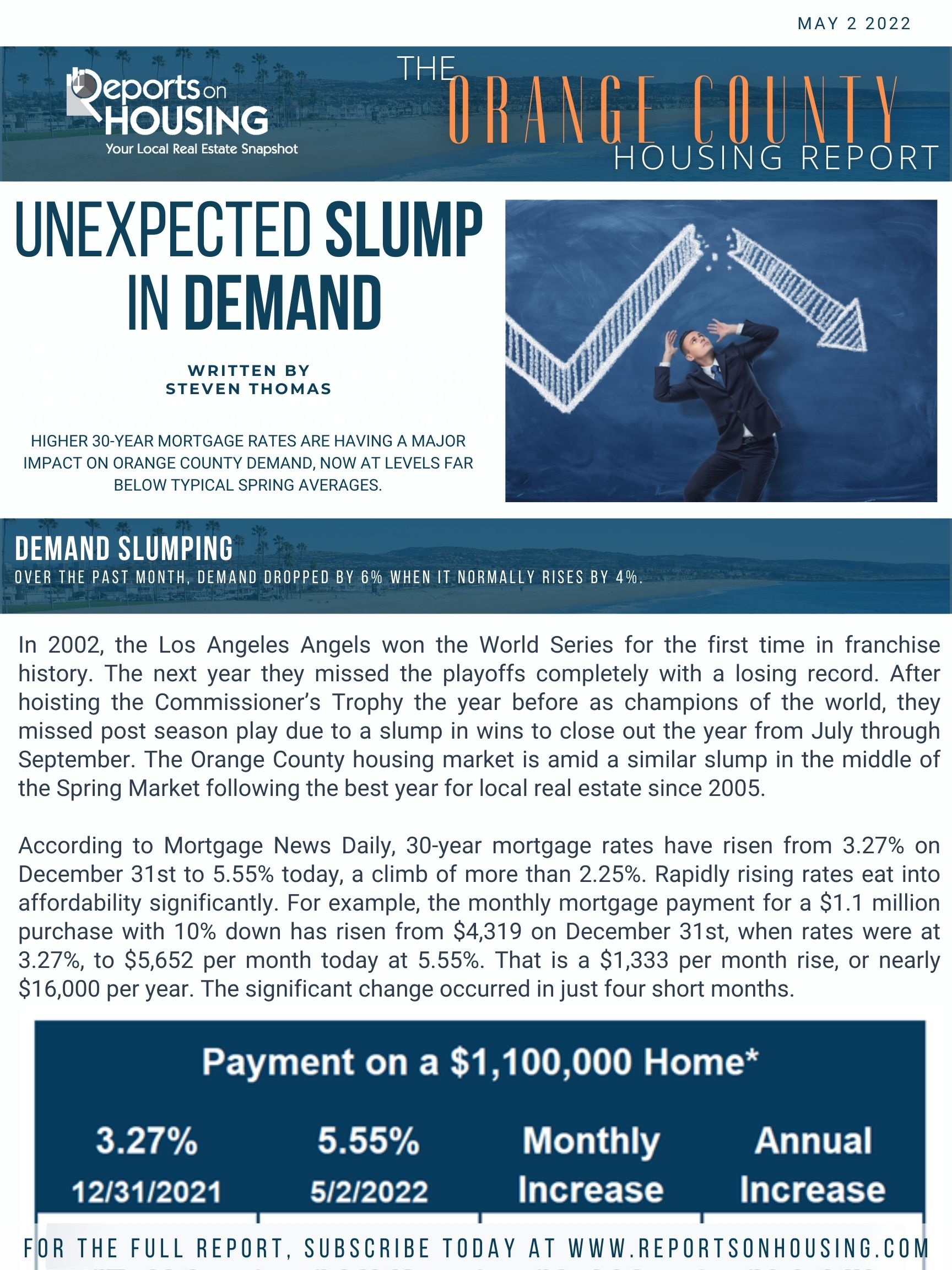

According to Mortgage News Daily, 30-year mortgage rates have risen from 3.27% on December 31st to 5.55% today, a climb of more than 2.25%. Rapidly rising rates eat into affordability significantly. For example, the monthly mortgage payment for a $1.1 million purchase with 10% down has risen from $4,319 on December 31st, when rates were at 3.27%, to $5,652 per month today at 5.55%. That is a $1,333 per month rise, or nearly $16,000 per year. The significant change occurred in just four short months.

California Association of REALTORS® reported that the median detached home in Orange County rose to $1,305,000 in March, up 27% in contrast to last year’s $1,025,000 median. At these levels, rising mortgage rates significantly impact payments.

In response rising rates, demand has slowed considerably. Demand, the prior 30-days of pending sale activity, has been on the decline after peaking on March 31st, shedding 6%, or 132 pending sales, since. Usually demand peaks from the end of April to the end of May. This year, with rapidly rising rates, many buyers backed off purchasing, the peak occurred early, and not everything is selling instantly.

Demand has stalled this spring. During the Spring Market, demand normally is on the rise along with the active listing inventory. More homes come on the market during the spring than any other time of the year. There is cyclically more escrow activity because that is when families desire to open escrow in hopes of closing and moving at the end of spring or during the summer when the kids are out of school. The housing market cyclically revolves around families and the school year. Spring is when there is the most activity, followed by summer. Then housing decelerates during the autumn after the kids go back to school. It then downshifts further during the holidays, the slowest time of the year.

Housing is moving away from everything selling in an instant. Instead, carefully arriving at the asking price will swiftly become the fundamental initial step in successfully selling. The housing inventory will grow on the backs of homes that will not sell. Homes in inferior locations, like backing to a busy street, need to be priced according to their inferior location. Homes that are in poor condition and need a lot of work must adjust their prices appropriately. Sellers who OVERPRICE their homes will sit on the market until they adjust to their Fair Market Value. Housing will no longer absorb overpriced homes, or homes in poor condition or a poor location.